共享情报,共同防御

Shared intelligence and common defense

-

身处攻防第一线 抵御互联网威胁

身处攻防第一线 抵御互联网威胁 -

建立动态防御面 极大提升攻击难度

建立动态防御面 极大提升攻击难度 -

应对攻防演练 反溯追踪攻击队

应对攻防演练 反溯追踪攻击队 -

建立攻击者情报网 让黑客无所遁形

建立攻击者情报网 让黑客无所遁形

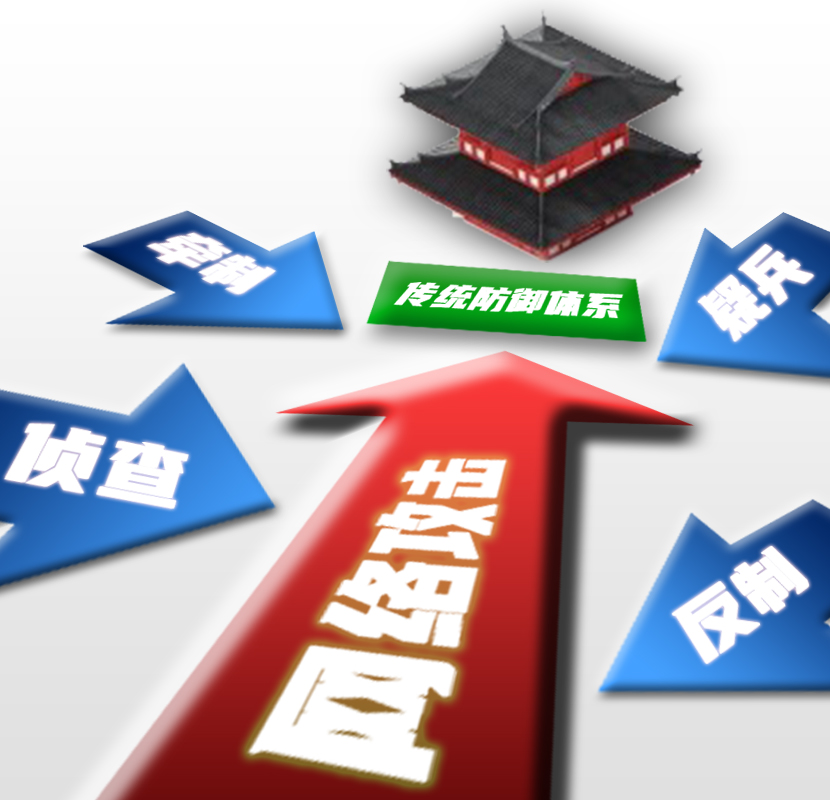

创新防御思路

传统的网络安全防护策略如同拥城固守,被动防御 影安电子创新WEB防御策略,为客户建立:- 城外的机动力量,骚扰,疑兵、疲兵,削弱并牵制对手

- 动态防御的战场上,反向侦查,反制对手。

动态防御+拟态防御

- 使WEB攻击面动态化,令攻击者难以有效的锁定攻击目标和攻击弱点。水平不够的攻击者望而却步,水平更高的攻击者则需要花费更多时间精力来达成目标。

- 借鉴自然界中一些动物的习性,如灯笼鱼(模拟亮光诱捕猎物),如变色龙(改变自身颜色适应环境)。通过营造假目标、假弱点,在攻防中持续诱使攻击者上钩,同时将真实弱点隐藏在复杂背景中。

反向侦查+攻击者情报体系

- 通过动态防御+拟态防御构建起的先进防御能力,用空间换取了宝贵的侦查、响应时间,方案通过分析攻击者行为、采集网络/软件/硬件指纹、虚拟身份定位等多种方法综合侦查攻击者,建立攻击者情报和画像。

- 对攻击者的侦查情报汇总上传至“攻击者情报网”,从而构建起面向攻击者的情报体系,为影安电子的客户及产品提供情报支撑,建立针对攻击者的情报优势。打破长久以来防守方信息孤岛的状态,建立针对攻击者的情报优势。

影安产品

影形-拟态威胁猎捕系统

SaaS化的WEB威胁诱捕系统- 提供高仿真诱捕系统

- 标识并建立攻击者画像

- 反制攻击者,获取证据

- 助您建立主动防御的能力

影阵-WEB动态防御系统

硬件化的WEB防御设备- 与传统防护设备相辅相成

- 为WEB服务建立动态攻击面

- 反制攻击者,获取证据

- 辨认已标识攻击者,建立威胁预警、预防能力

影域-攻击者情报网

部署于互联网/专网中的情报服务- 与影安电子产品节点联动,发现的攻击者情报统一上传至情报网

- 情报分享给影安电子客户,建立针对攻击者的情报优势

影安服务

安全运维服务

安全通告、安全监测、安全分析、安全检查、安全扫描、安全加固、安全事件处理、应急响应、安全演练以及安全培训等服务。

等保建设服务

- 风险评估

- 差距性分析

- 等保测评辅助

- 合规建设咨询

风险评估服务

- 前期调研准备

- 风险要素识别

- 风险分析

- 风险处置

安全咨询服务

- ISO27001咨询

- 等级保护咨询

客户案例

合作伙伴